How We Booked Our Banff Family Trip on Points + Miles

Affiliate Disclosure: This post may contain affiliate links and personal credit card referral links. As an Amazon Influencer I earn from qualifying purchases. If you use these links, my family may earn a referral bonus or a small commission at no extra cost to you. I only share products and cards we personally use and recommend. For more information please visit our Disclosures page.

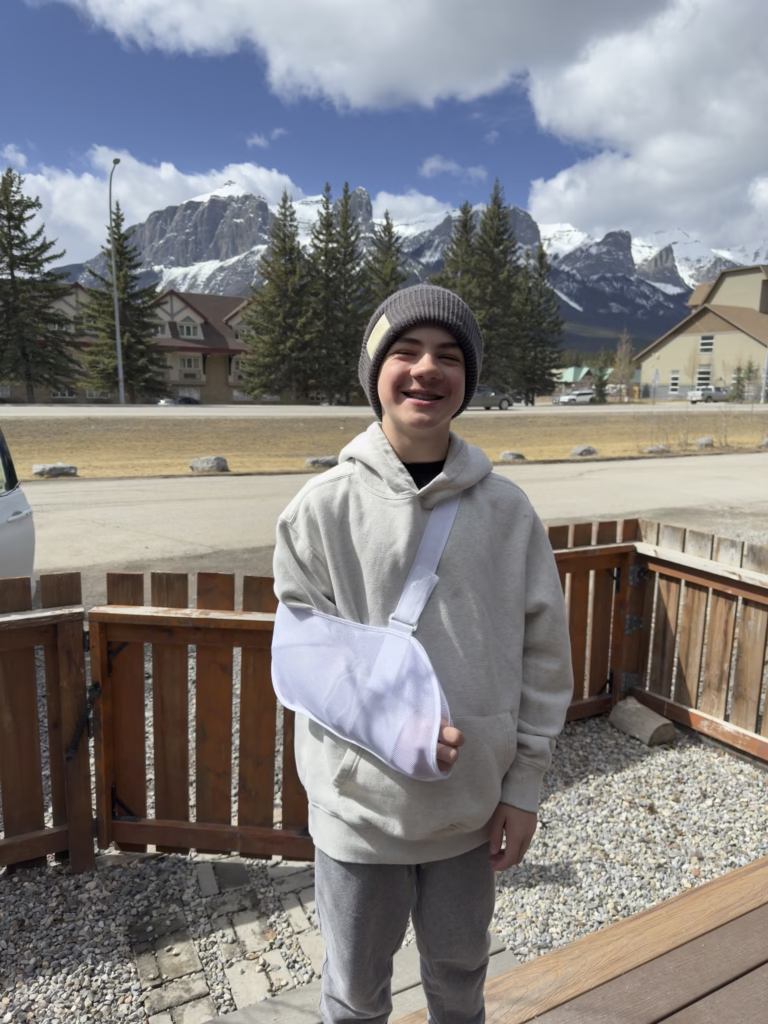

All photos in this post were taken by me during our trip. I love capturing real experiences to give you an authentic look at what to expect.

Why is it that bucket list destinations have to have bucket list level pirce tags?

Banff National Park is absolutely one of them. But if you learn to master the points and miles game, you can travel to Banff with your kids for significantly cheaper!

Our family went to Banff for spring break and used points and miles to cover most of the cost of our flights and rental car.

We’ve been using points and miles to travel for years, and it is what has enabled us to go on so many incredible adventures as a family. Banff was our first international family trip, and I’m so thankful we had the points to cover a lot of the cost and make it possible.

If you’ve been wondering whether points and miles can actually work for a big family trip, they can! I’ll show you exactly how we booked our flights and rental car for (almost) free, and how you can too.

Let’s break down the exact cards we used, how we booked everything with points, and what cards I would open now if I were planning this same trip again.

Our Points + Miles Strategy

I always like to start by writing down the points I have available before planning our family adventures. Paying the least amount out of pocket starts with knowing your resources!

For this particular trip, we were starting with 50,000 Delta Miles, a $250 Capital One travel credit, and 81,600 Capital One Miles.

Several months before our trip, we opened the Delta Skymiles Gold card and the Capital One Venture card to build our stash of points. We earned welcome bonuses for opening both of these cards and meeting a minimum spend.

We used our Delta miles to book two flights to Calgary for my husband and son, and booked directly with Delta. We used 50,000 miles for the flights, and then we paid cash for the taxes and fees, which totaled $133.

We then used our $250 Capital One travel credit and 47,500 miles for the remaining two flights we needed. We booked the same Delta flights but through the Capital One travel portal. Our miles covered the cost of the flights, taxes, and fees.

We had 34,100 Capital One miles left to cover other travel purchases. We used these miles to cover the rental car that we booked through Expedia with Capital One’s “cover travel purchases” feature.

Our out of pocket cash cost for flights and rental car should have been $1793, but because we used travel credit cards, we only spent $133!

Planning your own family trip to Banff? Grab our free winter packing list so you don’t forget the essentials!

Points + Miles Basics

If you’ve never used a travel credit card to book a family vacation, let me walk you through the basics!

When you sign up for a new travel credit card, you can earn a one time Welcome Bonus. This welcome bonus comes in the form of points, miles, and/or credits that can then be used to book travel!

Travel points have been a game-changer in our family’s life and have enabled us to travel way more than we would otherwise!

We like to use our points and credits to cover fixed costs like flights, hotels, and rental cars. For us, food and fun expenses are flexible and can be easily toned down or up depending on our cash budget for the trip!

There are a few things to note when you are traveling with points and miles:

- Only use credit cards for purchases you were already planning to make. Think bills, groceries, insurance premiums – any monthly bills or typical spending.

- Don’t carry a balance, and pay your bill in full each month. Debt and paying interest negate any rewards you may earn!

- Space out applications at least 90 days apart to keep a good relationship with the banks and your credit score healthy.

- Don’t add a spouse or partner as an authorized user. Instead, refer them to open their own card. You’ll earn a referral bonus and they’ll earn a welcome bonus!

- Use tools like Thrifty Traveler or Points Path to check award seat values to find the best points value for your trip.

- Set price alerts for future trips. Be ready to book when you get an alert as flight values fluctuate quickly!

- Be flexible with dates when possible. We are often traveling around school schedules, so our flexibility is limited. But sometimes we’ll leave in the evening after school or miss a day of school if the fares are significantly cheaper.

- Use Rakuten or the Capital One shopping portal to get bonus miles and cash back on regular purchases.

Credit Cards We Used for our Flights

We used the Delta Skymiles Gold card to book 2 of our flights directly with Delta. We booked our other two flights with Capital One miles and travel credits from the Venture card.

How to Book a Delta Skymiles Deal

- Navigate to the Delta website

- Sign in to your SkyMiles account.

- Put in your destination airport (YYC if you’re headed to Calgary like us!)

- Add your preferred trip dates

- Select the “shop with miles” checkbox. (This will take you to a new screen with a calendar view so you can see the best dates to fly. The lowest fares are often in green!)

- Click on the flight dates you like the best.

- Select convenient times for your family. (Pay attention to the points value because the cost can change depending on the flight time.

- Go through the checkout process and pay any taxes, fees, or insurance with your Delta Gold SkyMiles card. This card gives you a free checked bag!

- You can add travel insurance to your purchase before checking out. **We highly recommend doing this! We paid $56 for our insurance, and it covered our son’s $1100 ER visit in full.

We only had enough Delta miles to cover two flights at 25,000 points each. We paid $133 cash for the taxes and fees.

We still needed two more flights, and we needed to use our Capital One miles.

We headed to the Capital One travel portal to search for the same Delta flights. Thankfully, we were able to find them and had the option to use points and credits to check out. We had enough to cover the flights, taxes, and fees. Our out of pocket cost for these two flights was $0.

If you’re booking flights through two different portals – double check the airports, flight times, and the flight numbers are all the same!

At the time, I didn’t realize you could transfer Capital One miles to Delta’s airline partners like Flying Blue and Virgin Atlantic and use them to book Delta flights. This could offer significant savings, especially during a transfer bonus.

We like to learn as we go around here. We still got a great flight deal, and now you don’t have to make the same mistakes we did. Win, win!

Want to book your flights with points too?

👉 Apply for the Capital One Venture Card

👉 Apply for the Delta Gold Card

Book a Rental Car with Expedia + Cover with Points

When we’re making our travel budget, I almost always forget the rental car cost. I love destinations where you don’t need one, like Europe, but for Banff, we definitely needed a car. We always compare costs between booking directly with a rental agency, booking through a bank travel portal, and booking through Expedia.

We choose whatever is cheapest, and that’s really going to depend on the dates and the destination. For this particular trip, booking through Expedia was half the cost of both booking direct and the Capital One Travel Portal.

We booked a minivan for 8 days on Expedia for $340, and paid with our Capital One card. We used their “cover travel purchases” feature to cover the full cost of the rental, and had a $0 out of pocket cost!

How to Cover Travel Purchases with Capital One

- Log in to your Venture card

- Select ‘View Rewards’

- Select ‘Cover Travel Purchases’

- Select the purchase you would like to cover

- Add the amount of miles you’d like to use

- Click ‘Continue’

- Click ‘Confirm’

**Important note: There isn’t a minimum mile requirement – you can use as few or as many miles as you’d like to cover a purchase. You don’t have to cover a purchase in full, but you do have to cover purchases within 90 days.

We used 31,400 points to cover the cost of our rental car, but we could have also put it towards our VRBO rental. In the end, the amount we saved is the same, and I liked being able to zero out an entire budget item with points.

We booked a condo with friends and split the cost 3 ways, which made our out of pocket cost for 7 nights in Banff just $812. If you’re not traveling with others or prefer hotels, there are a lot of great Canmore hotel options in this same price range!

We booked our rental car for free with points from this card:

👉 Get the Capital One Venture Card

We think it’s one of the most flexible cards for family travel!

Credit Card Benefits & Perks We Used

I love taking advantage of credit card points to help cut the cost of our trips, but it’s not the only reason to use travel cards! I love booking with points and miles because of the bonus benefits the credit cards have! We took advantage of several on our spring break trip to Banff.

Travel Insurance

Capital One has built in travel insurance for purchases made on the card. Two of our flights, the rental car, and the VRBO rental were covered through this policy. Be sure to read the fine print about cancellations and rental car coverage for peace of mind that you have all the coverage you need for your trip.

Delta also gives you the option to add trip insurance when booking flights. We added it for our 2 Delta points flights, and it included not only trip insurance but medical benefits while we were in Canada as well. This was the insurance we used to cover the cost of our son’s ER visit.

No Foreign Transaction Fees

Both the Venture Card and the Delta Gold card offer no fees for foreign transactions. Fees can really add up when you’re charged on each transaction, so this is a valuable reason to open a travel card.

We used our Venture card for every purchase while we were in Banff because you earn 2 points for every dollar spent! All those yummy Canmore restaurants were earning us points! I love earning points for my next trip while I’m still on vacation.

TSA Precheck (Venture)

The Capital One Venture card comes with a statement credit for TSA PreCheck. You purchase the service and pay for it with your Venture card. You then get an automatic statement credit covering the cost!

PreCheck has saved us so many times. We would have missed our flights on our Banff spring break trip without it! This benefit has alleviated a lot of stress, especially when we’re traveling with the kids.

Your kids are able to come with you through the PreCheck line if they’re on the same booking as you. Each adult needs their own TSA PreCheck account.

Lounge Access (Venture X)

We saved hundreds in the Calgary airport by using the lounge access Priority Pass benefit that comes with Capital One Venture X. We ate all of our airport meals and snacks there, and it was such a good experience for us!

It was so nice to have a safe space to wait with our kids for our flights and have access to clean bathrooms. My teen especially loved that he could have all the food and drinks he wanted because it was all-inclusive.

**Important note: The rules are changing in February 2026 for the Priority Pass access for Venture X cardholders. You will no longer be able to take guests into the lounge with you for free. Read all the policy changes here.

Free Checked Bag (Delta)

Each ticket we booked with our gold card came with a free checked bag. We took advantage of both of these free bags and used them to pack all of our bulky winter gear and heavy snow boots!

This was great for the flight there, but we didn’t realize it doesn’t cover the cost of the bags on the way home! Because our flight was operated by a partner airline, we had to pay for checked bags when we arrived at the airport.

Their app was down for online check in, so this may have been different if we hadn’t checked in in person.

15% Award Flight Discount (Delta)

When you are a gold card member, you automatically get a 15% discount on award flight! I love this because it helps my miles go further and fund more trips!

Points + Miles We Used to Book our Banff Trip

Family of 4 traveling from the US to Calgary for 8 days, 7 nights

Flights: Booked with Delta Miles + Capital One Travel Credit & Miles

Rental Car: Booked with Expedia, Covered with Capital One Miles

Want to plan your own family adventure using points and miles?

These are the exact cards that made our trip possible:

Capital One Venture

Delta Gold Card

One Card I Would Open Now For a Trip to Banff Next Year

If you’re ready to book your own family trip to Banff using points and miles, the card I’d start with is the Capital One Venture card! The miles are so versatile, and the card benefits bring significant savings and perks!

This card does have a $95 annual fee (at the time of writing), but it is offset by the TSA PreCheck credit.

Use the card to pay for all necessary spending to work towards earning the welcome bonus! Make sure you are only using the card for typical expenses, and that you are spending enough to meet the minimum spend requirements in the bank’s timeframe.

Once you’ve built your stash of points, start planning your next core memory adventure!

Other Ways to Save on a Trip to Banff

Using points and miles to cover some of the significant expenses on our trip was the top way we made this dream trip possible for our family.

To cover the rest of the spending, we set up a trip budget! We use YNAB to track our spending on trips (and at home) to make sure we’re staying within the budgeted amounts we’ve set.

We set a reasonable target for each category, and fund them before our trip. I then set up transaction push notifications through our bank app. At the end of the day, I track the transactions into their appropriate categories.

I do this daily (or multiple times a day if we’ve had some big purchases) so we can always know if we have enough in the budget to cover a spontaneous ice cream stop or another moose mug. Priorities, you know?

We also had the cost in mind when planning our itinerary, excursions, and food plan, so we could enjoy Banff on a budget! If you’re interested in how our family found even more significant savings, check out our Banff on a Budget post.

✈️ Read: Banff on a Budget: How Families Can Save Without Missing Out

Happy Travels,

💛 Michelle